quickbooks credit card processing limit

Click the symbol Customer payment. Create an expense account called Merchant Fees On the home screen navigate to the Receive Payments icon and click on it.

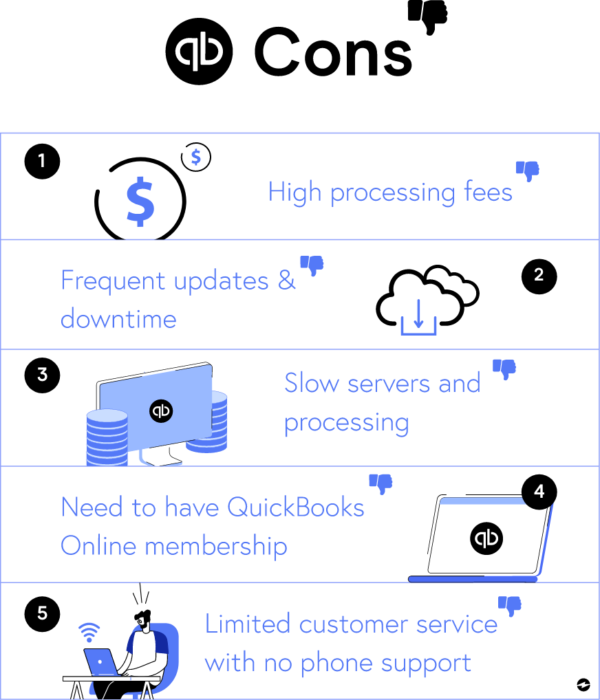

The cost of QuickBooks processing varies depending on how much you need to process per month and your plan.

. Find the customer or click to add their customer information. Entering your credit card purchases into QuickBooks Online and then matching. If you use QuickBooks and also accept credit cards through QuickBooks Payments you might have discovered that your processing fees are very high.

Plus if you key in transactions regularly or if you process card not present transactions CNP then your rate goes up to 35. Select the proper credit card for the credit card charge you want to enter if you only have one credit card QuickBooks will automatically select that credit card account. Also be aware that if you process more than 7500 per month you should be eligible for custom processing rates which should be lower than the advertised Intuit credit card processing fees.

GoPayment green app steps for Processing customer credit card payments for open invoices in QuickBooks Online are. As the crime unfolded it seemed almost cartoonish in its scope. This is actually a good thing as it keeps you from overpaying on most of your transactions.

Limit of one 1 Discounted Clover Mini or one 1 other Clover POS system. Choose the relevant customer on the drop-down menu. Credit charges when we do nearly 100 bank transfers.

Their flat fee however starts at 025 for smaller transactions but can go up as high as 2 or more if youre making larger payments in bulk. For instance for a 10000 exchange QuickBooks Mastercard handling will charge the accompanying. Overall the costs are excellent for both small and established businesses looking for card processing solutions.

Receipt expenses - 29025. Buyer must open a Merchant Account through us for use with the Clover POS System. Select the credit card account you used from.

To enter a credit card credit in QuickBooks Online click the New button in the Navigation Bar. ACH expenses - 10. ACH fees 1 with a maximum of 10.

If your business is new your merchant account will come with a set monthly volume cap maybe 80000 depending on your provider. Nearly 40000 of charges in a few hours when wed set our account limit for a whole month to 10000. Enter the payment account and payment option.

According to US News Quickbooks processing gets a 35 50 just because of their high credit card processing fees. Configuring Credit Card Processing in Acctivate. Quickbooks Payments prioritizes customer rates depending on a few different factors.

Here are some simple steps to help you keep track of transaction fees. On the Payment Info tab enter the credit limit in the field provided. Swipe expenses - 24025.

You could create a system where credit card payments are not allowed for invoices above a certain value. Enter the transaction and then match to the bank feed. How to get a higher processing volume limit.

Verify Type Of Credit Card Transaction. Take customer payment in advance in the GoPayment green app for QuickBooks Online. Allow customers to pay via credit card only if the invoice value is less than 100.

Double click the name of the customer for whom you want to set a credit limit. 34 interchange feeQuickBooks credit card processing fee for keyed in credit card numbers are more than the maximum interchange fee listed by VISAIn the US for B2B payments this can be reduced to up to 165 if level 2-3 data is being sent for VISA which is usually enabled on most. The easiest way to avoid paying huge credit card fees would be by not allowing your customers to pay using a credit card in the first place.

You should regularly run the accounts receivable AR aging report to. Record the credit limit for this customer. ACH expenses - 10.

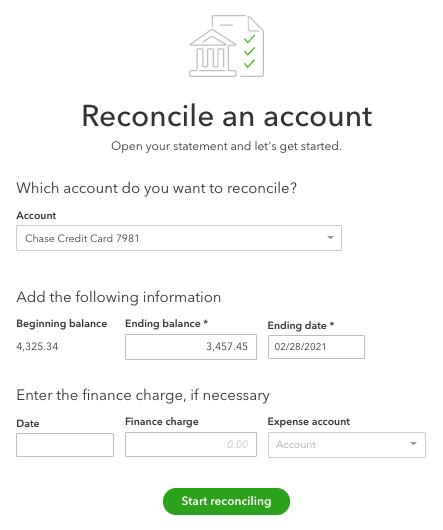

Additionally there is no service length requirement or termination fee for cancelling the QuickBooks credit card processing option. Some QuickBooks Online QBO Payments users have a limit of how much they can get paid online for both ACH Bank Transfer or Credit Card in a 30-day rolling period. In order to take credit card payments however you will need to use a credit card processing company.

The exchange expenses for labor and products worth 1000 are as per the following. The costs are little for significant credit card payments and they are lower than PayPal rates. Ecommerce merchants are charged 030 per transaction.

But as soon as your business begins growing you will need to raise it to say 150000 or 200000. Keyed installment expenses - 34025. Select the vendor from whom you made the purchase by using the Payee drop-down.

Each company reduced credit card processing fees more than 50 by leaving Intuit. Unfortunately it can be confusing to know which credit card processor is right Select Region. Two credit card charges of 19000 each when our average ticket is 80.

However merchants who accept a free copy of QuickBooks in exchange for setting up a QuickBooks Payments account may be subject to a software recovery fee if they cancel service within 24 months of opening the account. Instead of a one-size fits all approach Durango Merchant Services works with each client according to their needs. Call Now Qualify for a FREE QuickBooks Pro and Credit Card Processing 800-457-2507.

Take a moment to make sure that PurchaseCharge is selected so that your credit card charge is properly recorded. QuickBooks credit card processing Interchange fees are way through the roof. Then click the Credit Card Credit link under the Vendors heading in the menu that appears to open the Credit Card Credit window.

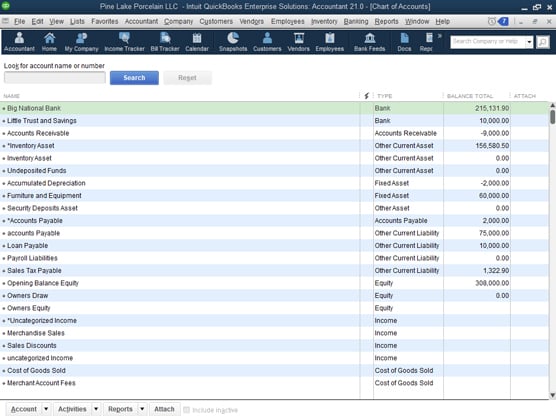

In the following examples we will look at actual Intuit processing statements sent to CardFellow by companies that used our free marketplace to get instant credit card processing quotes. Recording Credit Card Processing Fees In QuickBooks. Set a customer credit limit by following these steps.

Intuit also charges a flat fee per transaction which costs 025 for Quickbooks Online Quickbooks Desktop and Pay as You Go. Here are the fees that business owners will incur when using QuickBooks.

How To Get A Credit Limit Increase On A Credit Card Credit Card Payoff Plan Credit Card Deals Paying Off Credit Cards

10 Step Guide How To Use Quickbooks Online Float

Solved Is There A Limit On The Dollar Amount Qbo Can Accept From A Customer Who Is Paying Their Invoice

How To Properly Enter Credit Cards In Quickbooks Workshop Live Q A Youtube

10 Step Guide How To Use Quickbooks Online Float

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Credit Card Transactions In Quickbooks 2021 Dummies

Is There A Limit To How Much Can Be Processed When A Customer Pays For An Invoice Through Quickbooks Online

9 Pros And Cons Of Using Quickbooks Payments In 2022

Quickbooks Payments Review 2022 Intuit Merchant Services

Recording Credit Card Transactions In Quickbooks Best Practices

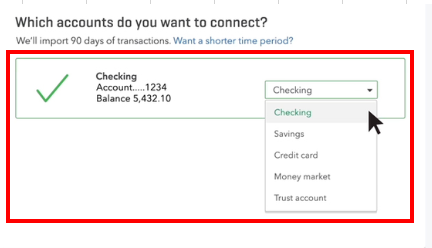

Connect And Review Your Banking In Quickbooks Online

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Advantages And Disadvantages Of Credit Cards Credit Card Paying Off Credit Cards Personal Finance Advice

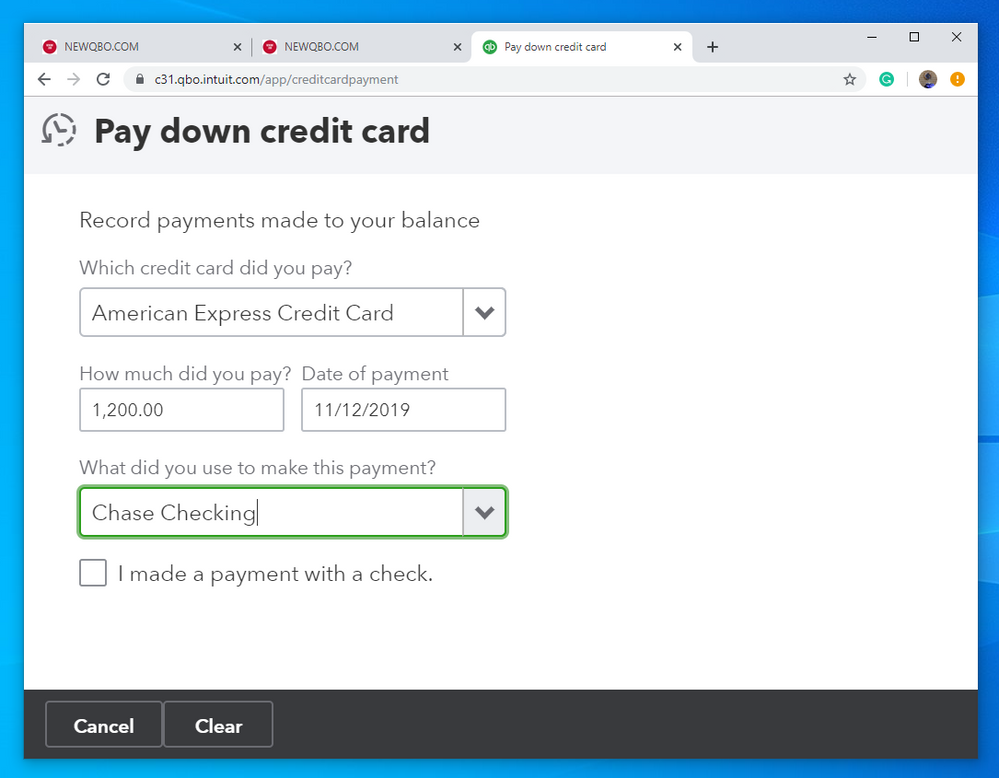

Which Option Completes The 3 Missing Steps To Use The Pay Down

Solved How Does The New Feature Pay Down A Credit Card Work Does It Replace The Bill Entry Or Expense Screen When Paying A Credit Card Payment

How To Set Up A Credit Line In Quickbooks Online And Have It Import Transactions